About the Author

Sarah Jones is a seasoned financial journalist with over a decade of experience covering business and economic trends. She holds a Master’s degree in Economics and is passionate about demystifying complex financial topics for a general audience.

Is rising oil a recipe for economic prosperity or a harbinger of trouble? As oil prices inch closer to the much-watched $90 per barrel mark, a wave of uncertainty washes over the US economy. This article explores the potential impacts on a diverse audience, from everyday consumers to seasoned investors and policymakers.

Oil Prices on the Rise: A cause for Concern?

The recent surge in oil prices can be attributed to several factors. Geopolitical tensions in major oil-producing regions, coupled with the ongoing global economic recovery, have created a situation of high demand and constrained supply. Additionally, the war in Ukraine has further disrupted energy markets, pushing prices even higher. While this might seem like a positive development for oil-producing nations and companies, the ripple effects can be far-reaching.

The Double-Edged Sword of Oil: Benefits for Producers

Undoubtedly, a high oil price environment benefits oil producers in the short term. Increased revenue translates to higher profits and potentially increased investment in exploration and production. This can lead to a period of economic growth within the oil and gas sector, creating jobs and boosting local economies heavily reliant on energy production. However, it’s crucial to remember that this boom is often cyclical. Historically, periods of high oil prices have often been followed by price crashes, leading to economic instability within the energy sector.

Consumers Feel the Pinch: Rising Gas Prices and Beyond

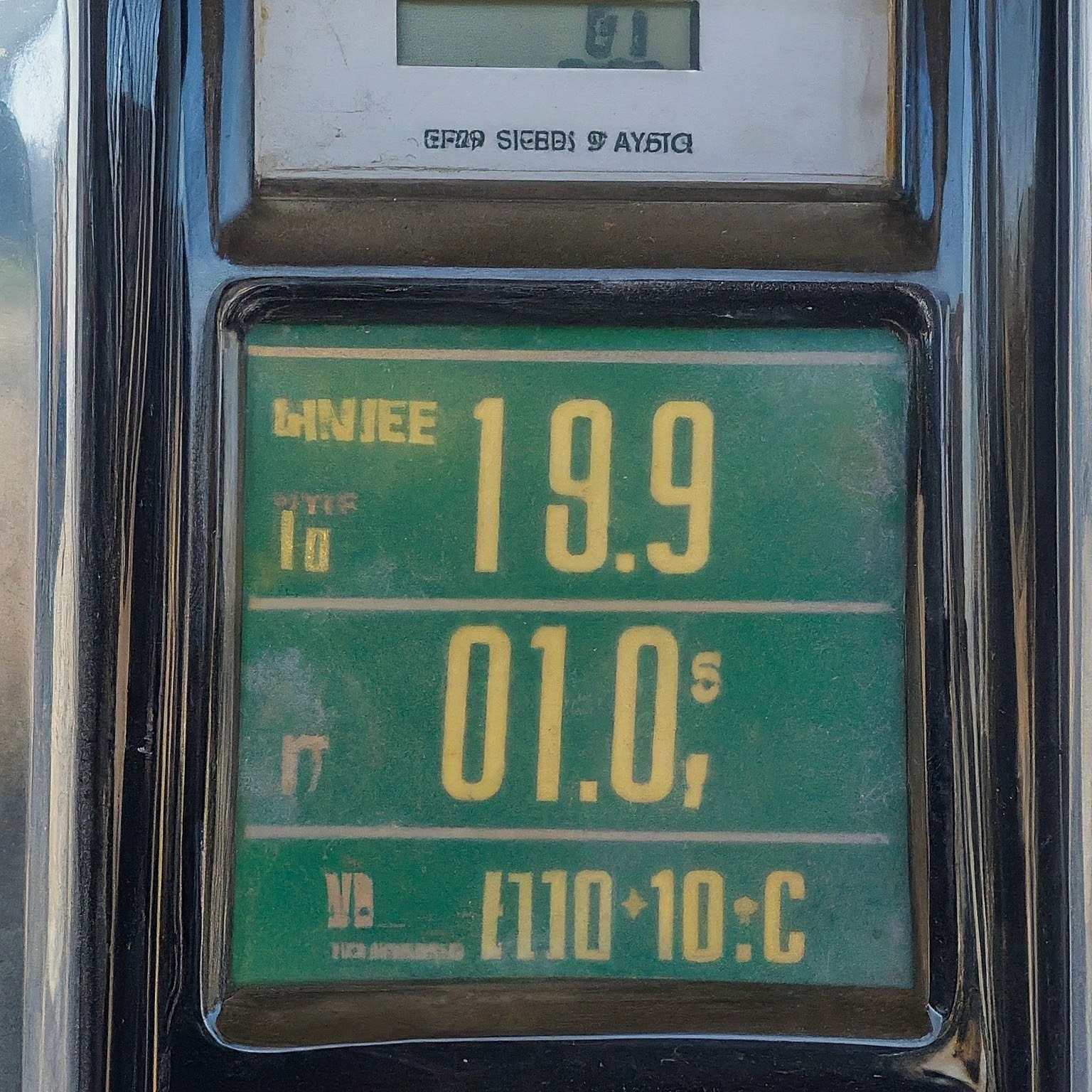

For most Americans, the most immediate impact of rising oil prices is felt at the gas pump. As crude oil prices climb, so do gasoline prices, directly impacting household budgets. According to a recent report by the American Automobile Association (AAA), the national average gas price in the United States has reached its highest level in five months, exceeding $4 per gallon in some regions. This translates to higher transportation costs for everything from commuting to work to taking a family vacation.

But the impact goes beyond just gas. The rising cost of oil can also lead to increased prices for a wide range of consumer goods. Since oil is a key input in the production and transportation of many products, a price hike can trickle down the supply chain, ultimately impacting the cost of everyday items on grocery shelves.

Investor Jitters: Stock Market Implications

For investors, the rising oil price scenario presents a complex situation. While energy sector stocks may experience a surge in value due to increased company profits, the overall market can become volatile. Concerns about inflation and potential economic slowdown due to higher consumer spending can lead to market fluctuations. Investors need to carefully monitor economic indicators and diversify their portfolios to mitigate risk during this period of uncertainty.

Policymakers at the Helm: Navigating the Oil Price Surge

Policymakers face the daunting task of balancing economic growth with inflation control. One potential strategy involves the release of oil from the Strategic Petroleum Reserve (SPR), a stockpile of crude oil maintained by the US government. This can help increase supply and potentially ease downward pressure on oil prices. Additionally, policymakers may consider temporary tax breaks for consumers to alleviate the burden of rising gas prices. However, such measures need to be carefully calibrated to avoid hindering long-term economic goals.

A Look Ahead: Will Oil Prices Stay High?

Predicting the future of oil prices is no easy feat. The long-term trajectory depends on several factors, including geopolitical developments, the pace of global economic recovery, and most importantly, the transition towards renewable energy sources.

If the current geopolitical tensions ease and alternative energy sources gain traction, oil prices might stabilize or even decrease. However, if the existing supply constraints persist and the shift towards renewables takes longer than anticipated, oil prices could remain elevated for a significant period.

So, Boom or Bust? The Verdict is In…

The impact of rising oil prices on the US economy is multifaceted. While some sectors may experience a temporary boost, the overall economic outlook remains uncertain. The key lies in understanding the potential consequences across different segments and preparing for various scenarios.

Consumers:

- Revisit your budget and adjust spending plans to accommodate higher gas prices and potential price increases for other goods.

- Consider exploring fuel-efficient vehicles or carpooling options to save on transportation costs.

- Look for ways to reduce energy consumption at home, such as adjusting thermostats and utilizing energy-efficient appliances.

Investors:

- Diversify your investment portfolio to minimize risk associated with market volatility.

- Monitor economic indicators and stay informed about geopolitical developments that could impact oil prices.

- Consult with a financial advisor to develop investment strategies tailored to your risk tolerance and financial goals.

Policymakers:

- Closely monitor the evolving situation and consider releasing oil from the SPR if necessary.

- Explore policy options to mitigate the impact on consumers, such as temporary tax breaks.

- Promote long-term energy security by encouraging investment in renewable energy sources and energy efficiency initiatives.

Conclusion:

The recent surge in oil prices presents a complex economic puzzle. While some may view it as an opportunity, for others, it represents a significant challenge. By staying informed and adapting to changing circumstances, consumers, investors, and policymakers can navigate this period of uncertainty with greater confidence.

The Road to a Sustainable Future:

The current oil price situation underscores the critical need to accelerate the transition towards renewable energy sources. Investing in solar, wind, geothermal, and other clean energy technologies can help reduce dependence on volatile fossil fuels and ensure long-term energy security for the US economy.

Furthermore, promoting energy efficiency through stricter fuel economy standards for vehicles and investment in energy-efficient building technologies can significantly reduce overall energy consumption. This not only benefits consumers by lowering energy bills but also lessens the economic impact of fluctuating oil prices.

In conclusion, the recent oil price surge serves as a wake-up call. It highlights the vulnerability of the US economy to the whims of the global oil market. By embracing renewable energy solutions and promoting energy efficiency, the US can chart a course towards a more sustainable and secure energy future, one that is less susceptible to the boom-and-bust cycles of fossil fuels.