For decades, fixed income investments had been a reliable source of returns for investors, as yields rose steadily and bond prices remained stable. This led to what was known as the ‘Golden Age’ of fixed income investing, where investors could enjoy consistent profits with minimal risk. But all good things must come to an end. In 2022, the bond market saw one of its most dramatic selloffs in history, wiping out trillions of dollars in value and ending the ‘Golden Age’ of fixed income investing as we knew it. In this blog post, we will explore how the 2022 Bond Rout shook up the financial markets and what it means for investors moving forward.

What Caused the 2022 Bond Rout?

In the summer of 2022, a perfect storm of events conspired to cause a bond rout that wiped out trillions of dollars in value and ended the so-called “golden age” of fixed income investing.

The first trigger was a surprise announcement from the Federal Reserve that it would begin tapering its bond-buying program sooner than expected. This sent shockwaves through the markets and caused interest rates to spike.

The second trigger was a series of weak economic data releases, which called into question the strength of the recovery and led to renewed fears of inflation. This caused investors to dump bonds and push prices lower.

The third trigger was the European Central Bank’s decision to wind down its own bond-buying program. This added more selling pressure to an already volatile market and sent prices tumbling even further.

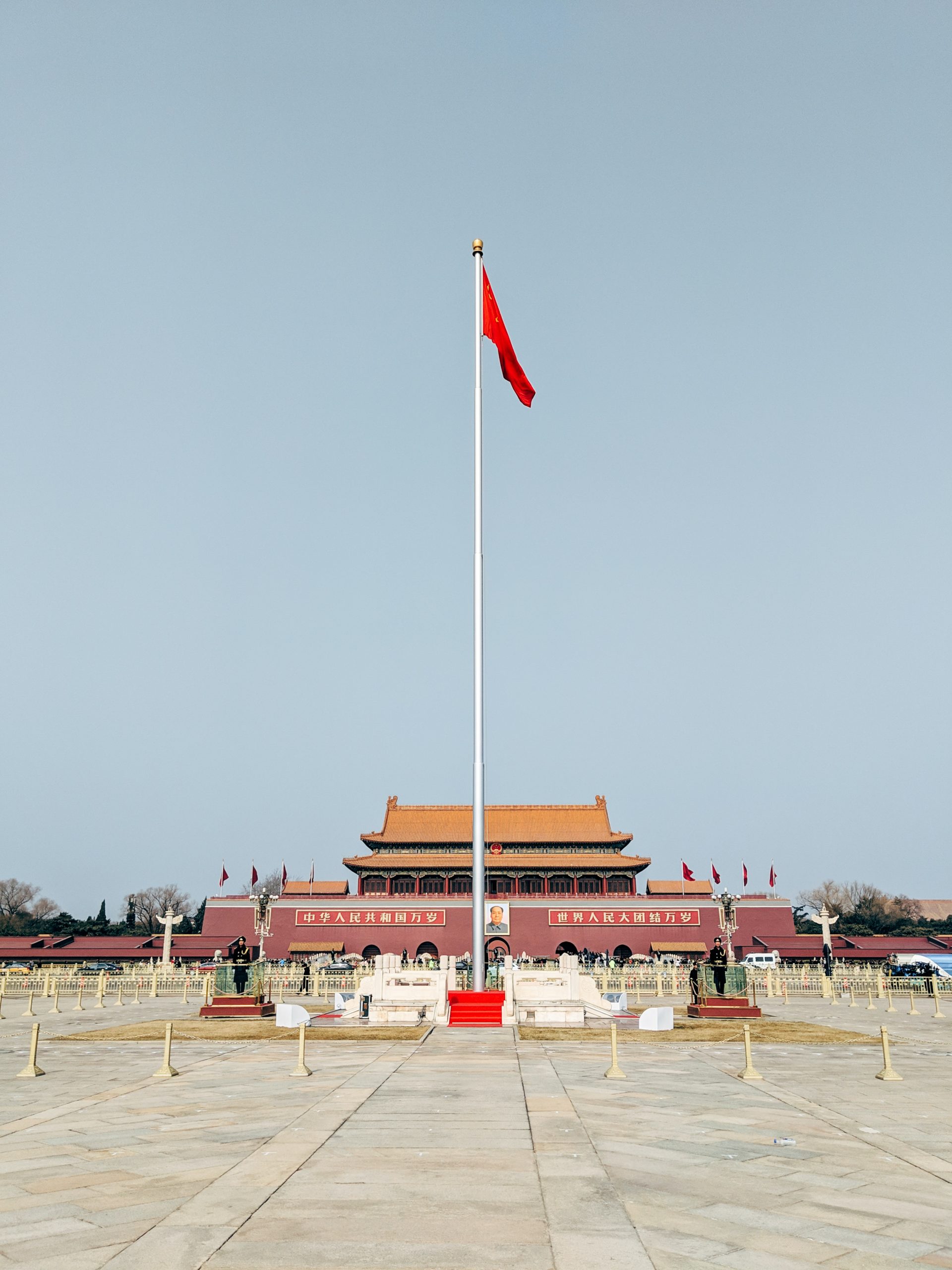

The final nail in the coffin came when China announced plans to slow its own economy, which sent shockwaves through global markets and caused a further sell-off in bonds.

The result was a bond rout of historic proportions that wiped out trillions of dollars in value and ended the golden age of fixed income investing.

The Aftermath of the 2022 Bond Rout

The bond rout of 2022 was one of the most significant events in the financial markets in recent history. It marked the end of the so-called “Golden Age” of fixed income investing, which had seen years of strong performance for bond investors.

In the aftermath of the rout, many investors were left reeling. The market for bonds had been one of the few bright spots in the investment world in recent years, and the sudden drop in prices came as a shock to many.

While there are still some uncertainties about what caused the bond rout, there are a few things that we do know. First, it was driven by a combination of factors, including rising interest rates, concerns about inflation, and fears about the sustainability of debt levels around the world. Second, it caught many investors off guard, as most were unprepared for such a sharp decline in prices.

And finally, while the immediate aftermath of the rout was painful for many investors, it also presents an opportunity for those who are willing to take on more risk. In particular, high-yield bonds and other risky assets have become much more attractive relative to safer investments like government bonds.

So if you’re looking for opportunities in the wake of the bond rout, don’t be afraid to take on a little more risk. There are plenty of attractive options out there for those who are willing to look beyond traditional safe havens like government bonds.

What Does This Mean for Fixed Income Investors?

In the wake of the recent bond rout, fixed income investors are grappling with how to adjust their portfolios. Many have been caught off guard by the sharp sell-off in bonds, which has upended years of calm markets and low interest rates.

The bond rout has ended the so-called “golden age” of fixed income investing, where investors could simply buy bonds and count on them to provide stability and modest returns. Now, investors must contend with a more volatile market environment and consider a wider range of options for their portfolios.

While there are no easy answers, it’s important for fixed income investors to stay focused on their long-term goals and objectives. By taking a disciplined approach to portfolio construction, investors can weather the current market turbulence and position themselves for success in the years ahead.

Conclusion

In conclusion, the 2022 bond rout was a major event in fixed income investments that has changed the way investors approach bonds. The rise and fall of interest rates during this period brought to light many vulnerabilities in the world of fixed income investments, calling into question the ‘Golden Age’ which had previously seemed so stable. Despite this instability, investors are still able to find success by understanding their risk tolerance and diversifying their portfolios to ensure they have a good balance between risk and reward.