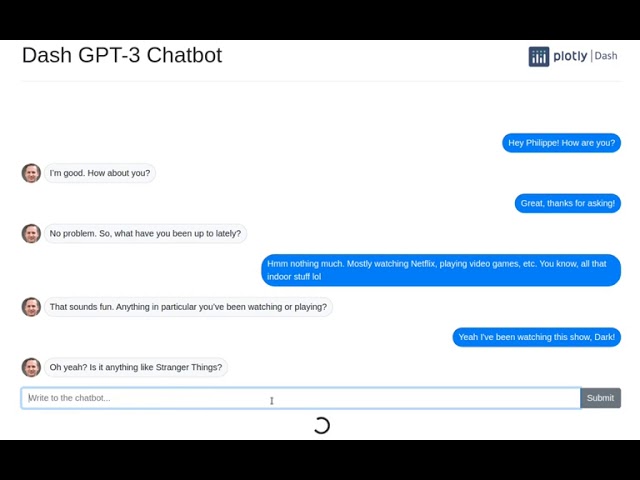

Chinese Chip Gear’s Breakthrough: A Backer’s Insight

Introduction

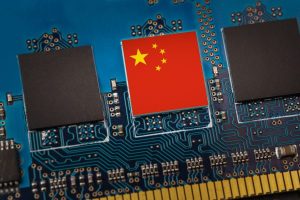

The semiconductor industry is one of the most dynamic and competitive sectors in the world, driven by innovation, demand, and geopolitics. The development of advanced chips is crucial for various applications, such as artificial intelligence, 5G, electric vehicles, and renewable energy systems. However, producing these chips requires specialized equipment that is costly and complex to manufacture.

One of the key players in this equipment market is SMIC (Semiconductor Manufacturing International Corporation), China’s largest chipmaker. SMIC has been struggling to catch up with its rivals in terms of technology and capacity for years, due to sanctions imposed by the U.S. government that limit its access to advanced tools from ASML (Netherlands), the world’s leading supplier of lithography machines.

However, SMIC has recently announced that it has achieved a technological breakthrough in chipmaking gear, according to its backer Eric Xu, the rotating chairman at Huawei, China’s leading telecom company. Xu claimed that SMIC has developed “quasi-7nm” chips with the FinFET N+1 process using DUV (deep ultraviolet) machines, which are older but more reliable than EUV (extreme ultraviolet) machines.

This breakthrough could have significant implications for SMIC’s future growth and competitiveness in the global semiconductor industry. It could also affect other Chinese chipmakers and their relations with foreign suppliers. In this article, we will explore what this breakthrough means for SMIC and its backer Eric Xu, as well as how it could impact the global semiconductor market.

What is Quasi-7nm Technology?

Quasi-7nm technology refers to a process node that is slightly below 7nm in size. A process node is a measure of how small a transistor can be on a chip, which determines its performance and power efficiency. The smaller the node number (such as 7nm or 5nm), the more transistors can fit on a chip without increasing its cost or complexity.

However, achieving smaller nodes requires using more advanced lithography machines that can print millions of tiny patterns on silicon wafers using light or electrons. These machines are expensive and difficult to operate due to their sensitivity to environmental factors such as temperature and humidity. Moreover, they require high levels of precision and quality control to ensure consistent results.

ASML is currently leading the market for EUV lithography machines, which can print patterns with sub-10nm nodes using extreme ultraviolet light. ASML’s EUV machines are considered essential for producing high-end chips with cutting-edge features such as 3D stacking or extreme ultraviolet direct bandgap (EUV-DBG) technology. These features enable chips to perform faster calculations or store more data than conventional transistors.

However, ASML’s EUV machines are not widely available yet due to technical challenges and high costs. As of December 2020, only TSMC (Taiwan Semiconductor Manufacturing Company), ASML’s main customer, had access to EUV machines from ASML. TSMC uses EUV machines to produce chips with 5nm nodes or higher at its advanced fabs in Taiwan.

SMIC has been trying to catch up with TSMC by developing its own DUV lithography machines since 2019. DUV lithography machines use deep ultraviolet light instead of extreme ultraviolet light to print patterns on silicon wafers. DUV lithography machines are older but cheaper than EUV machines due to their simpler design and lower power consumption.

SMIC claims that it has successfully developed “quasi-7nm” chips with DUV lithography machines using FinFET N+1 process technology. FinFET stands for fin field-effect transistor

r, which is a type of transistor structure that uses three-dimensional fins instead of two-dimensional planar structures like conventional transistors. FinFET transistors have higher performance than planar transistors because they reduce leakage current and improve charge transport.

N+1 refers to an enhancement technique that improves FinFET transistors by adding a thin layer of silicon germanium (SiGe) on top of the fins, which increases the mobility of electrons and holes. This technique also reduces the resistance and capacitance of the transistors, which improves their switching speed and power efficiency.

SMIC claims that its quasi-7nm chips with FinFET N+1 process can achieve 20% more performance, 57% less power consumption, and 63% higher transistor density than its previous 14nm chips. SMIC also claims that its quasi-7nm chips can compete with TSMC’s 7nm chips in terms of performance and power efficiency.

However, some experts have expressed doubts about SMIC’s claims, arguing that quasi-7nm is not a standard term and that SMIC’s process may not be comparable to TSMC’s 7nm process. They also point out that SMIC’s quasi-7nm chips may not be able to support advanced features such as 3D stacking or EUV-DBG technology, which are essential for high-end applications such as AI or 5G.

Why is SMIC’s Breakthrough Important?

SMIC’s breakthrough in chipmaking gear is important for several reasons. First, it shows that SMIC is making progress in developing its own lithography technology, which could reduce its dependence on foreign suppliers and increase its self-reliance. This is especially crucial for SMIC, as it faces increasing pressure from the U.S. government, which has imposed export restrictions on SMIC and its customers, citing national security concerns.

Second, it demonstrates that SMIC is capable of producing chips with smaller nodes and higher performance, which could enhance its competitiveness in the global semiconductor market. This is also vital for SMIC, as it faces fierce competition from other chipmakers, such as TSMC, Samsung, Intel, and AMD, which are constantly innovating and upgrading their technologies and products.

Third, it indicates that SMIC is willing to invest in research and development, which could foster innovation and growth in the Chinese semiconductor industry. This is also beneficial for SMIC, as it could attract more customers and partners, both domestic and foreign, who are looking for alternative sources of chips and equipment.

How Does SMIC’s Breakthrough Affect Its Backer Eric Xu?

SMIC’s breakthrough in chipmaking gear also affects its backer Eric Xu, who is the rotating chairman at Huawei, China’s leading telecom company. Huawei is one of SMIC’s major customers and investors, as well as one of its strategic partners in developing chip technology.

Huawei has been facing similar challenges as SMIC, as it has been targeted by the U.S. government, which has banned Huawei from using U.S. technology and components, including chips, for its products and services, citing national security risks. This has severely affected Huawei’s business and operations, especially in its core segments of smartphones and 5G networks.

Huawei has been trying to overcome these challenges by developing its own chips and equipment, as well as diversifying its supply chain and markets. However, Huawei still relies on SMIC for some of its chips, especially for its low-end and mid-range devices. Therefore, SMIC’s breakthrough in chipmaking gear could benefit Huawei in several ways.

First, it could help Huawei secure a stable and reliable source of chips, which could reduce its vulnerability to U.S. sanctions and disruptions. This could also enable Huawei to maintain or expand its market share and customer base, both in China and abroad.

Second, it could enable Huawei to access more advanced and efficient chips, which could improve its product quality and performance. This could also allow Huawei to offer more competitive and innovative products and services, especially in emerging fields such as AI, cloud computing, and IoT.

Third, it could strengthen Huawei’s collaboration and cooperation with SMIC, which could foster mutual learning and exchange of technology and expertise. This could also create more synergies and opportunities for both companies, as well as for the Chinese semiconductor industry as a whole.

How Does SMIC’s Breakthrough Impact the Global Semiconductor Market?

SMIC’s breakthrough in chipmaking gear also impacts the global semiconductor market, which is undergoing a period of transformation and uncertainty. The global semiconductor market is influenced by various factors, such as demand, supply, innovation, competition, and geopolitics.

The demand for semiconductors is growing rapidly, as more devices and applications require chips to function and perform. The demand is especially high for chips that support emerging technologies, such as AI, 5G, electric vehicles, and renewable energy systems. However, the supply of semiconductors is limited, as the production of chips requires sophisticated equipment, materials, and skills, which are scarce and expensive.

The innovation of semiconductors is also accelerating, as chipmakers are constantly developing new technologies and products to meet the changing needs and expectations of customers and markets. The innovation is also driven by competition, as chipmakers are vying for market share and leadership in various segments and regions.

The geopolitics of semiconductors is also intensifying, as chipmakers are affected by trade disputes, sanctions, regulations, and alliances, which shape the global distribution and flow of chips and equipment. The geopolitics is also influenced by national interests, as chipmakers are seen as strategic assets and partners for economic development and national security.

SMIC’s breakthrough in chipmaking gear could have various effects on the global semiconductor market, depending on how it plays out in the long term. Some possible effects are:

- SMIC could become a more competitive and influential player in the global semiconductor market, especially in China and Asia, where it has a strong presence and customer base. SMIC could also challenge or collaborate with other chipmakers, such as TSMC, Samsung, Intel, and AMD, in different segments and regions.

- SMIC could contribute to the diversification and localization of the global semiconductor supply chain, which could reduce the dependence and dominance of certain players and regions, such as the U.S. and Taiwan. SMIC could also support the development and growth of other Chinese chipmakers and equipment makers, which could create a more balanced and resilient global semiconductor ecosystem.

- SMIC could stimulate the innovation and advancement of the global semiconductor technology, which could lead to the creation of new and better chips and products for various applications and markets. SMIC could also share and exchange its technology and expertise with other chipmakers and equipment makers, which could foster mutual learning and cooperation in the global semiconductor community.

- SMIC could affect the geopolitics and dynamics of the global semiconductor market, which could result in more conflicts or collaborations among different players and regions, depending on their interests and goals. SMIC could also influence the policies and regulations of the global semiconductor market, which could affect the trade and flow of chips and equipment.

Conclusion

SMIC’s breakthrough in chipmaking gear is a remarkable achievement that reflects its progress and potential in the global semiconductor industry. It also has significant implications for its backer Eric Xu, as well as for the global semiconductor market. However, SMIC’s breakthrough also faces many challenges and uncertainties, such as technical difficulties, quality issues, market acceptance, and political risks. Therefore, SMIC will need to continue to invest in research and development, improve its quality and reliability, expand its capacity and customer base, and cope with the changing and complex global semiconductor environment.