Introduction

In today’s high-cost living environment, the decision to invest in private health insurance is more complex than ever. This article explores the factors influencing this decision, the trade-offs involved, and features insights from financial expert Dr. Sarah Reynolds to help individuals make informed choices amid economic challenges.

The Economic Landscape

Understanding the current economic challenges sets the stage for evaluating the worth of private health insurance. This section delves into the factors contributing to the high-cost living environment, from inflation to housing and education expenses, and how these impact healthcare decisions.

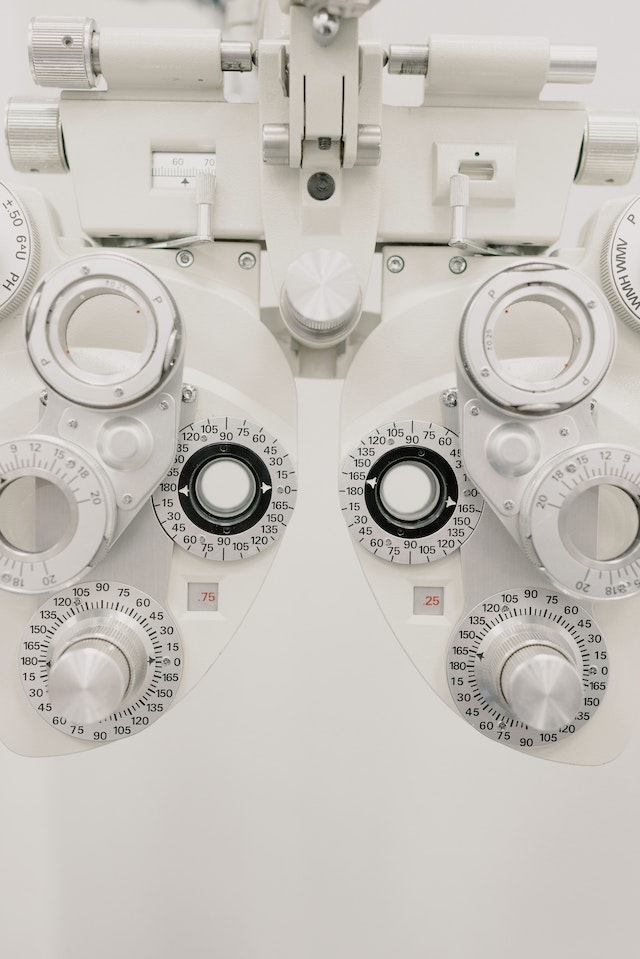

The Case for Private Health Insurance

The article explores the potential advantages of private health insurance that may justify the costs. From access to a broader network of healthcare providers to faster services and customizable coverage options, understanding these benefits is crucial for an informed decision.

Expert Analysis: Dr. Sarah Reynolds’s Insights

Table: Key Insights from Dr. Sarah Reynolds

| Key Insights | Analysis |

|---|---|

| Financial Planning Considerations | Explores how private health insurance fits into the broader financial planning strategies amid the current cost of living challenges. |

| Evaluating Health Needs | Analyzes the importance of assessing individual healthcare needs, risk tolerance, and budget constraints when considering private health coverage. |

| Alternatives and Risk Mitigation | Discusses alternative healthcare options, risk mitigation strategies, and potential long-term financial implications of health coverage decisions. |

Considering Alternatives

Balancing the potential benefits are considerations of alternative healthcare options. This section covers topics such as public health coverage, health savings accounts (HSAs), and employer-sponsored plans as potential alternatives to private insurance.

Comparative Analysis: Private vs. Public Health Coverage

| Aspect | Private Health Insurance | Public Health Coverage | Considerations for Decision-Making |

|---|---|---|---|

| Premium Costs | Higher premiums, customizable options. | Lower premiums, standardized coverage. | Assessing budget constraints and desired coverage flexibility. |

| Network Access | Broader network, potential for faster services. | Limited network, longer wait times for certain services. | Balancing access needs with budget considerations. |

| Coverage Flexibility | Customizable coverage based on individual needs. | Standardized coverage with less customization. | Evaluating the importance of tailored coverage options. |

| Affordability Concerns | Potential financial strain, especially for comprehensive plans. | More affordable options, but with potential coverage gaps. | Aligning coverage needs with budgetary constraints. |

Making an Informed Decision

This section provides practical guidance for individuals to make informed decisions about private health insurance in the context of the current cost of living. It includes tips on budgeting, researching policies, and seeking professional advice for personalized insights.

Conclusion

The article concludes by emphasizing the importance of thoughtful consideration and personalized evaluation when determining the value of private health insurance amid the challenges of the current high-cost living environment. Dr. Sarah Reynolds’s insights provide a comprehensive understanding of the economic landscape and considerations for optimal health coverage decisions.