Sendwave, a reliable tool for instantaneous international money transfers, was created especially to serve users sending money to Asia and Africa. Sendwave distinguishes itself from its rivals by emphasizing quick, safe, and affordable transfers. Sendwave’s features, advantages, and current events—such as its acquisition by WorldRemit and its regulatory issues with the Consumer Financial Protection Bureau (CFPB)—will all be covered in this article. This post will offer a thorough response to any questions about “Is Sendwave safe?” or “How does Sendwave compare to other transfer services?”

1. First, what is Sendwave? A Summary

Sendwave is a mobile app that offers reasonable exchange rates and minimal costs for sending money to Asian and African nations. With just a few clicks, users may transfer money straight to their bank balances or mobile wallets using the app’s straightforward, user-friendly platform.

The Operation of Sendwave

- Get the app from the Apple App Store or Google Play.

- Create an account by entering personal data for validation.

- Enter the recipient’s information, such as bank account or mobile wallet data.

- Choose the currency and amount, verify the transaction, and send!

Important Features

- Quick money transfers between Asia and Africa

- Minimal or nonexistent transmission costs

- Straight transfers to bank accounts or mobile wallets

- 24/7availability around-the-clock and prompt customer service

2. The Purchase of Sendwave by WorldRemit and Zepz

To increase its market share in the remittance industry, WorldRemit, a significant cross-border payments provider, purchased Sendwave in 2020. Additionally, a new brand, Zepz, was created as a result of the transaction and is currently the parent company of both Sendwave and WorldRemit. This collaboration establishes Sendwave as a top money transfer provider and increases its ability to offer dependable, affordable remittances.

Effects of the Purchase

Sendwave benefited from the acquisition by having more security features and access to a wider network of financial institutions. Because of WorldRemit’s wide global reach, Sendwave has been able to grow its services and give customers more dependability.

3. CFPB Action and Regulatory Obstacles

Chime Inc., Sendwave’s operator, was fined by the Consumer Financial Protection Bureau (CFPB) in 2023 for making false statements on the cost and speed of transfers as well as for providing subpar customer service. This action served as a reminder to Sendwave to improve openness, emphasize consumer protection, and align its services with regulatory standards.

Recognizing Sendwave’s Adherence to Financial Rules

Sendwave has taken action to guarantee greater adherence to financial regulations and enhance its openness with relation to costs, processing delays, and currency rates since the CFPB involvement. Customers can now anticipate more rapid customer service and more transparent disclosures.

4. Advantages of Sendwave Money Transfer Services

Here are some of the core benefits that make Sendwave an excellent choice for international remittances:

Instant Transfers to Supported Countries

Sendwave’s transfers are nearly instantaneous, particularly for mobile wallet transactions. This feature makes Sendwave ideal for urgent transfers or emergencies.

Affordable Transfer Fees

Sendwave offers low or no fees for many transfer routes. This affordability is particularly beneficial for users sending smaller amounts, where fees might otherwise eat into the transfer value.

Competitive Exchange Rates

The app offers competitive exchange rates, often better than traditional banks or wire transfers. This means users get more value per dollar sent.

Example: A user sending money from the U.S. to Nigeria may see a significant difference in received funds due to Sendwave’s favorable rates compared to a traditional bank.

Secure Transactions

Sendwave prioritizes the security of every transaction. With end-to-end encryption and compliance with data protection laws, users can trust their funds are handled safely.

5. How to Use Sendwave: Step-by-Step Guide

- Download the App: Available for both iOS and Android.

- Create an Account: Register with your phone number and complete identity verification.

- Add a Payment Method: Link your debit or credit card for quick payments.

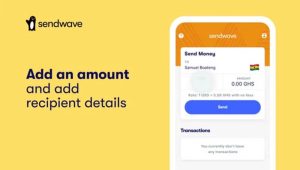

- Choose Recipient Details: Enter their bank account or mobile wallet information.

- Enter Amount and Send: Confirm the amount and transfer currency.

- Receive Confirmation: Both sender and recipient get notifications upon successful transfer.

Example Use Case:

Consider Mary, who lives in the U.S. and wants to send $200 to her family in Kenya. Using Sendwave, she quickly completes the transaction without paying hefty fees, and her family receives the funds in their mobile wallet within minutes.

6. Sendwave vs. Other Remittance Apps

When comparing Sendwave to other remittance services like Remitly, Wise, or PayPal, the following factors come into play:

Speed: Sendwave typically processes transfers instantly, which can be faster than some services that take several days.

Fees: With low or zero fees, Sendwave is competitive against services like Western Union, which often have higher costs.

Exchange Rates: Compared to banks and traditional wire transfers, Sendwave offers better exchange rates, maximizing the recipient’s received amount.

Transparency: The CFPB action has led Sendwave to improve transparency around fees, addressing previous complaints about hidden costs.

7. Drawbacks and Considerations

While Sendwave is convenient, it’s essential to be aware of a few potential drawbacks:

Limited Coverage:

Sendwave primarily focuses on African and select Asian countries. Users who wish to send money to Europe or Latin America may need another service.

Card-Based Transfers Only:

Sendwave only supports debit and credit card payments. Some users may prefer other payment options, like bank transfers or cash pickup.

Customer Support Issues:

Although customer support has improved since the CFPB ruling, some users report delays in getting help.

8. Frequently Asked Questions concerning Sendwave

Is it safe to use Sendwave?

Sendwave is safe in general, yes. The application conforms with regulatory norms and employs safe encryption. But it’s crucial to thoroughly review the transfer information and get in touch with customer service if there are any problems.

Are There Any Hidden Fees with Sendwave?

Sendwave has increased its fee transparency since the CFPB case. Users can anticipate accurate transfer information and unambiguous disclosures.

How Much Time Does Sendwave Take for Transfers?

The majority of transfers, particularly to mobile wallets, are completed promptly. However, depending on the recipient’s bank, bank transfers could take longer.

9. Sendwave’s Future: Improvements and Growth

The foundation for future growth into new areas, services, and enhancements has been laid by Sendwave’s collaboration with WorldRemit and parent firm Zepz. Customers may anticipate a more dependable platform, particularly as Sendwave improves its transparency and regulatory compliance.

10. Advice for Getting the Most Out of Sendwave

Here are some tips to make the most out of Sendwave’s services:

- Compare Exchange Rates: While Sendwave usually offers favorable rates, compare rates for high-value transfers to ensure the best deal.

- Set Up Notifications: Enable notifications to track transfer statuses and get real-time updates.

- Understand Your Limits: Some countries have transaction limits; make sure to check these before sending large amounts.

- Use Customer Support Proactively: If you have issues, reach out early for faster resolution.

Final Thought

Sendwave is still a reliable, practical, and reasonably priced choice for anyone wishing to transfer money to Asia or Africa. Sendwave keeps improving its service offerings while concentrating on user pleasure and transparency in spite of regulatory obstacles. Many people in the diaspora who wish to support loved ones overseas find that Sendwave satisfies their demands because to its simplicity of use, affordable prices, and quick transfer periods.