Introduction

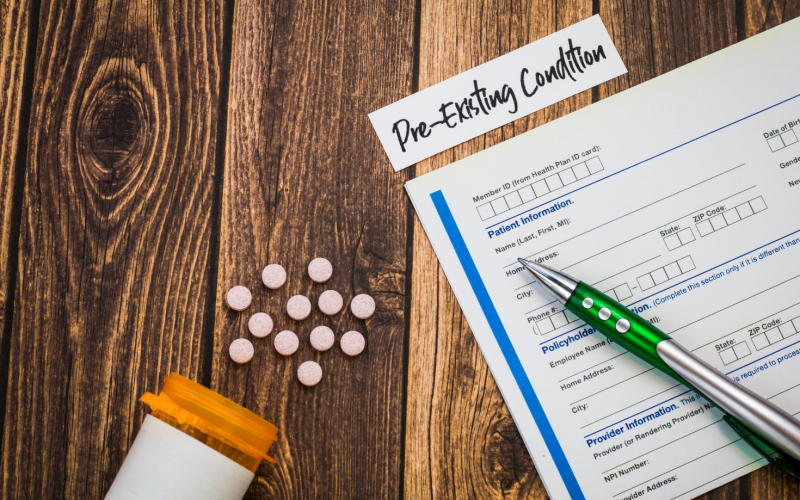

Understanding the relationship between pre-existing conditions and health insurance is vital for anyone navigating the complexities of the healthcare system. In this comprehensive guide, we’ll unravel how pre-existing conditions can impact your health insurance coverage, drawing on the expertise of Dr. Sarah Evans, a Medical Insurance Specialist with in-depth knowledge of health insurance regulations.

Unpacking Pre-existing Conditions

1. Pre-existing Conditions Defined:

- Overview: Health conditions that exist before obtaining health insurance coverage, ranging from chronic illnesses to past surgeries.

2. Impact on Health Insurance:

- Key Considerations: Pre-existing conditions can affect eligibility, premiums, and coverage options when obtaining health insurance.

3. Legal Protections:

- Key Considerations: The Affordable Care Act (ACA) provides important protections, prohibiting denial of coverage or increased premiums based on pre-existing conditions.

Dr. Sarah Evans’ Medical Insights

Dr. Evans emphasizes the importance of understanding the impact of pre-existing conditions on health insurance. “For individuals with pre-existing conditions, it’s crucial to be aware of their rights and the protections in place. Knowing how these conditions can influence coverage allows individuals to make informed choices and advocate for their healthcare needs,” she explains.

Decoding Pre-existing Conditions: Informative Tables

How Pre-existing Conditions Affect Health Insurance

| Aspect | Impact on Coverage |

|---|---|

| Eligibility | Before the ACA, individuals with pre-existing conditions faced denial of coverage or exclusion from certain plans. Now, insurance companies cannot deny coverage based on pre-existing conditions. |

| Premiums | In the past, individuals with pre-existing conditions often faced higher premiums. The ACA ensures that insurance companies cannot charge higher premiums based on health status. |

| Coverage Options | Some insurance plans may have exclusions or waiting periods for specific pre-existing conditions. Marketplace plans under the ACA cover essential health benefits, irrespective of pre-existing conditions. |

| Employer-sponsored Plans | Employer-sponsored plans are generally more lenient on pre-existing conditions, but the level of coverage can vary. The ACA protections still apply in these plans. |

Protections Under the Affordable Care Act (ACA)

| Protection | Explanation |

|---|---|

| Guaranteed Issue | Insurance companies are required to offer coverage to anyone, regardless of pre-existing conditions. |

| Community Rating | Premiums are based on factors like age and location but not on health status, preventing discrimination based on pre-existing conditions. |

| Essential Health Benefits | Marketplace plans must cover a set of essential health benefits, providing comprehensive coverage irrespective of pre-existing conditions. |

| No Annual or Lifetime Limits | The ACA prohibits imposing annual or lifetime dollar limits on essential health benefits, ensuring continued coverage for individuals with chronic conditions. |

Pre-existing Conditions and Marketplace Plans

| Scenario | Coverage Considerations |

|---|---|

| Newly Diagnosed Condition | You cannot be denied coverage based on a newly diagnosed condition. |

| Ongoing Treatment | Marketplace plans must cover ongoing treatments for pre-existing conditions. |

| Medication Coverage | Essential medications related to pre-existing conditions should be covered. |

| Specialist Visits | Visits to specialists for pre-existing conditions are typically covered. |

Conclusion

Navigating health insurance with pre-existing conditions requires a nuanced understanding of your rights and the protections in place. Dr. Sarah Evans’ insights, coupled with our breakdown of how pre-existing conditions can impact coverage and the legal protections under the ACA, aim to empower you in making informed healthcare decisions. Whether you are considering eligibility, evaluating premiums, or exploring coverage options, knowing your rights ensures that you can access the healthcare coverage you need, regardless of your health history.