Introduction

The world of real estate is changing fast. Investors must stay ahead to make smart choices. In 2025, new forces will shape where and how we invest in property. By understanding these shifts, you can align your portfolio with the future.

This article covers the top real estate investment trends for 2025. We’ll explain what drives these trends, how they will impact the market, and what you can do now. Whether you are a first‑time buyer or a seasoned investor, these insights will help you plan your next move.

What Are Real Estate Investment Trends?

Real estate investment trends are patterns that guide investors on where to put their money. These trends emerge from changes in technology, demographics, the economy, and government policy. By tracking trends, investors spot opportunities early and avoid risks.

A clear trend view helps you choose the right property investment strategies. It also shows which markets will grow fastest. For example, shifts in work styles or new building standards can radically change demand in certain areas.

What Factors Are Shaping the 2025 Real Estate Market?

Several forces are driving the 2025 real estate market forecast:

- Technology Adoption: Innovations in construction and management.

- Demographic Shifts: Aging populations and young professionals.

- Economic Conditions: Interest rates, inflation, and wages.

- Environmental Goals: Green building and energy efficiency.

- Lifestyle Changes: Remote work and mixed‑use communities.

Let’s explore how these factors shape the trends we expect in 2025.

The Role of Real Estate in a Balanced Investment Plan

Real estate plays a key role in balancing a portfolio. Unlike stocks or bonds, property is a tangible asset you can see and improve. It often moves differently from the stock market, smoothing out overall risk. Rental income can act as a hedge against inflation because rents usually rise when prices do. Also, owning property lets investors add value through upgrades and better management. By holding even a small share of real estate, investors can reduce shocks from other markets and build long‑term stability.

What Are the Top Forecasted Trends for 2025?

1. Trend: PropTech Innovations Accelerate

PropTech refers to proptech innovations that use technology to improve property buying, selling, and management. Virtual tours, AI valuation tools, and blockchain contracts will become common by 2025.

These tools cut costs and speed up buyer and seller deals. They also help investors analyze markets and spot bargains faster. Early adopters of PropTech will gain a clear edge in the 2025 real estate market.

Tip: Explore virtual tour platforms and AI‑driven analytics to stay ahead.

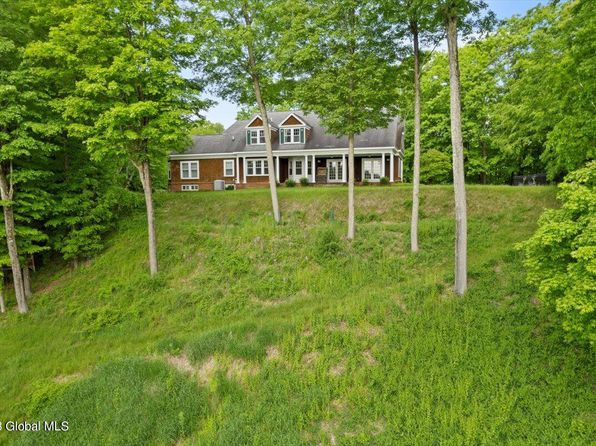

2. Trend: Suburban Migration Continues

Remote work is here to stay. Many workers now choose homes in quieter areas. This drives suburban migration trends, boosting demand for houses in smaller cities and towns.

As a result, suburban markets will see rising rents and home prices. Investors who spot up‑and‑coming suburbs can secure high returns before prices peak.

Tip: Look for suburbs with good internet, schools, and local jobs to find the best opportunities.

3. Trend: Sustainable Real Estate Development

Green building is no longer a niche. By 2025, sustainable real estate development will be a market standard. Energy‑efficient homes, solar panels, and recycled materials will attract both buyers and tenants and increase sales prices.

Governments and lenders often offer incentives for green projects. Investors who back eco‑friendly developments can tap into grants and tax credits, improving their profit margins.

Tip: Partner with developers who follow LEED or similar green building guidelines.

4. Trend: Rise of Short‑Term Rental Markets

Short‑term rentals in vacation spots and city centers are booming again. Platforms like Airbnb make it easy to manage these properties. In 2025, the rental market outlook will favor flexible stays over long‑term leases.

This trend offers high income per night, but also higher management costs. To succeed, investors should use tools that automate booking and maintenance.

Tip: Use a professional property manager or an automated system to handle bookings and guest communications.

5. Trend: Co‑Living and Co‑Working Spaces Grow

Younger professionals seek affordable, social living and working options. Co‑living apartments and co‑working offices will expand in urban hubs by 2025.

These commercial real estate models provide lower costs per person and built‑in community. Investors can benefit from higher occupancy rates and premium fees for shared amenities.

Tip: Research cities with a high share of freelancers and startups to find the best co‑living/co‑working markets.

6. Trend: Interest Rate Sensitivity

Rising interest rates can slow home sales and raise borrowing costs. By 2025, rate shifts will still sway the 2025 market forecast. Smart investors will lock in lower rates affordable housing when they appear and use fixed‑rate loans to avoid sudden cost hikes.

Tip: Work with lenders to secure the best long‑term rates and consider interest rate hedges if you own commercial property.

7. Trend: Demographic Demand for Aging‑In‑Place Housing

A large generation is entering retirement. They want to stay in their homes or move to accessible properties. This drives demand for aging‑in‑place communities and single‑floor designs.

Properties with medical access and community services will see higher values. Investors can focus on retrofitting existing homes or building new age‑friendly housing.

Tip: Seek markets with growing retiree populations and track local healthcare facility expansions.

How to Use These Trends in Your Investment Strategy

To make the most of real estate investment trends, follow these steps:

- Research local markets to see which trends align with regional demand.

- Diversify your portfolio across residential, commercial, and niche sectors like PropTech or co‑living.

- Partner with experts in green building, property management, and finance to access specialized knowledge.

- Stay flexible and adjust your strategy as economic and policy factors change.

By weaving these trends into your property investment strategies, you can build a resilient portfolio that thrives in 2025 and beyond.

Challenges Facing Real Estate Investors Today

Even with strong demand, real estate investing has hurdles. High home prices in popular cities make entry costs steep for new buyers. Rising interest rates can also raise monthly mortgage payments, cutting into returns. Property laws differ widely between regions, so investors must learn local rules on zoning, taxes, and tenant rights. Maintenance costs—like repairs, insurance, and vacancies—can surprise owners who lack a cash cushion. Finally, economic downturns or sudden shifts in work‑from‑home trends may cool certain markets faster than expected. Careful research and a clear budget plan are vital for overcoming these challenges.

The Future of Real Estate Investment Beyond 2025

Looking ahead, technology and changing lifestyles will guide the next wave of property trends. Smart‑home features, energy‑efficient designs, and shared work‑live spaces will likely attract both tenants and buyers. Virtual reality tours and blockchain‑based deeds may speed up sales and cut closing costs. Climate risks will push investors toward areas with stronger infrastructure and lower weather hazards. Governments may offer more incentives for green buildings, further shaping where money flows. As these shifts unfold, successful investors will stay flexible, use data to spot growth pockets, and focus on properties that meet future health, tech, and sustainability needs of real estate industry.

Comparative Table: 2025 Real Estate Investment Trends at a Glance

| Trend | Key Driver | Investor Action |

|---|---|---|

| PropTech Innovations | Technology adoption | Adopt AI tools, virtual tours, blockchain contracts |

| Suburban Migration | Remote work | Target emerging suburbs with good infrastructure |

| Sustainable Real Estate Development | Environmental regulations | Invest in green buildings with LEED certification |

| Rise of Short‑Term Rental Markets | Flexible stays | Use property‑management software |

| Co‑Living & Co‑Working Spaces | Millennial/Gen Z lifestyle | Partner with co‑living developers |

| Interest Rate Sensitivity | Economic policy | Lock in fixed‑rate loans and explore hedging |

| Aging‑In‑Place Housing | Aging population | Retrofit homes or develop age‑friendly communities |

Conclusion

The 2025 real estate market will be shaped by technology, changing lifestyles, and environmental goals. From proptech innovations to sustainable development, each trend offers new paths for investors. By focusing on key areas like suburban migration, short‑term rentals, and aging‑in‑place housing, you can capture growth and manage risk.

Success in property investing requires research, flexibility, and strategic partnerships. Use these real estate investment trends now to guide your decisions and secure long‑term returns in the evolving market.

Call to Action

Ready to align your investments with the future of real estate? Visit our website for in-depth guides, market reports, and expert advice to help you capitalize on these 2025 trends today.