Introduction

Warren Buffett is one of the most famous investors in the world. Yet many people do not know that his greatest successes come from the insurance business. Buffett turned small insurance firms into a powerhouse under Berkshire Hathaway. He used simple rules: buy well, manage risk, and keep costs low. His insurance legacy teaches us how smart float management and patient investing can create lasting value. In this article, we’ll look at how Buffett built his empire, why insurance is so important, the key strategies he used, and what lessons we can learn today.

The Role of Insurance in Buffett’s Empire

Insurance is different from other businesses. When customers pay premiums, the company holds that cash before paying claims. This money is called “float.” Buffett realized that float is like free money you can invest. He used float to buy stocks, bonds, and whole companies. Over time, this created huge gains. Today, Berkshire Hathaway has tens of billions of dollars in float. That money works day and night to earn more returns.

Early Moves: National Indemnity and GEICO

Buffett’s first big insurance deal was National Indemnity in 1967. He paid $8.6 million for a firm with $20 million of float. This was a dream purchase: he got float at a low price. Next came GEICO in 1996. GEICO sells insurance directly to people, cutting out agents. Its low-cost model and smart underwriting appealed to Buffett. Today, GEICO contributes a large share of Berkshire’s float. These two deals set the stage for massive growth.

Underwriting Discipline

Buffett insists on careful underwriting. Underwriting means deciding which risks to insure and at what price. Many insurance firms chase growth by lowering prices. Buffett does the opposite. He only writes policies where he expects profits. This discipline creates an “insurance profit,” or underwriting gain. When combined with float, these gains fuel further investments. Over decades, strict underwriting has protected Berkshire from major losses, even in storms or market crashes.

Investing the Float

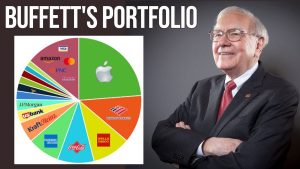

Float gives Buffett a low-cost source of capital. He invests float in quality businesses and stocks. Buffett looks for companies with strong brands, good management, and fair prices. He holds investments for years, even decades. This patient style benefits from compounding returns. For example, his investment in Coca-Cola began in 1988 and still returns dividends today. By 2025, Berkshire’s investment portfolio tops $350 billion, much of it grown from original float funds.

Key Principles Behind Buffett’s Success

- Economic Moats: Buffett seeks companies with an edge—like a strong brand or unique technology. Moats protect profits and make investments safer.

- Margin of Safety: He only buys when prices are below intrinsic value. This buffer must cover unexpected events, reducing risk.

- Long-Term Focus: Buffett ignores daily market noise. He holds great companies forever, letting earnings and dividends compound.

- Decentralized Management: Berkshire’s insurance units operate independently. Managers run day-to-day operations, while Buffett stays out of minor decisions. This boosts morale and efficiency.

By combining these principles with float management, Buffett created a powerful, self-funding machine.

Building a Culture of Trust

Buffett believes in letting trusted managers lead. At GEICO, he kept its leader, Tony Nicely, in charge. At National Indemnity, he honored existing teams. This culture of trust reduces bureaucracy. It attracts talent and ensures quick decisions. Berkshire’s annual letters show how important culture is for consistent performance. The insurance legacy thrives because people feel empowered and share Buffett’s long-term view.

Weathering Crises

Insurance faces big risks: natural disasters, pandemics, or economic downturns. Buffett’s disciplined approach helped Berkshire avoid dangerous losses during Hurricane Katrina and the 2008 financial crisis. He did not chase risky policies. Instead, he increased reinsurance—insurance for insurers—when others stepped back. This countercyclical approach earned extra float and profits. By staying strong when rivals weaken, Buffett further cemented his legacy.

Lessons for Today’s Insurers

Modern insurers can learn much from Buffett’s playbook:

- Focus on Profit, Not Just Growth: Profitable underwriting beats market share every time.

- Value-Driven Investments: Use float wisely. Invest only in businesses you understand.

- Strong Risk Controls: Avoid complex products you cannot price well. Keep operations simple.

- Leadership and Culture: Empower managers and foster long-term thinking.

These lessons apply beyond insurance. Any business that generates surplus cash can benefit from Buffett’s approach.

Future of Berkshire’s Insurance Empire

Even in 2025, Berkshire continues to expand. It added companies like Alleghany and re-entered reinsurance markets. Buffett and his team, including vice chairmen Ajit Jain and Greg Abel, focus on finding new float sources. They explore digital channels, pet insurance, and niche markets. As technology changes risk modeling, Berkshire aims to stay ahead with data and analytics. The legacy of disciplined underwriting and smart investing will guide its next chapters.

Conclusion

Warren Buffett’s insurance legacy rests on one simple idea: float is fuel for growth when paired with wise underwriting and patient investing. By buying firms like National Indemnity and GEICO, he secured vast float at good prices. His focus on margins of safety, economic moats, and strong culture built a resilient empire. Today’s insurers can follow his lead: prioritize profits, invest float carefully, and empower managers. Buffett’s model shows how steady discipline creates lasting success. His insurance legacy will inspire generations, proving that smart risk-taking and long-term vision can change industries forever.