About the Author:

Sarah Jones is a seasoned business journalist with over a decade of experience covering the commercial real estate and co-working industries. She has a keen eye for emerging trends and a passion for translating complex financial matters into clear and actionable insights for readers.

Navigating the New Landscape of WeWork

WeWork, the co-working giant that once symbolized the future of work, emerged from bankruptcy in 2023. But the company’s journey is far from over. This article dives into the current state of WeWork, exploring the challenges and opportunities that lie ahead for business people, investors, and real estate professionals.

Rebuilding Trust and Repositioning the Brand

WeWork’s past struggles, including overinflated valuations and aggressive expansion, left a mark on the co-working landscape. Regaining the trust of investors and potential tenants requires a strategic shift. WeWork is focusing on profitability, streamlining operations, and emphasizing strong community engagement within its workspaces.

A Comparative Look at WeWork’s Offerings

Table 1: WeWork vs. Traditional Office Space

| Feature | WeWork | Traditional Office Space |

|---|---|---|

| Flexibility | High (month-to-month contracts, variety of workspace options) | Low (long-term leases, limited flexibility) |

| Amenities | Included (Wi-Fi, conference rooms, printing services) | May require additional costs |

| Community | Focus on fostering collaboration and networking | Varies depending on the building and tenants |

| Scalability | Easy to scale up or down as needed | Can be difficult and expensive to adjust office size |

This table offers a quick comparison between WeWork and traditional office spaces, highlighting the key features and benefits relevant to business leaders.

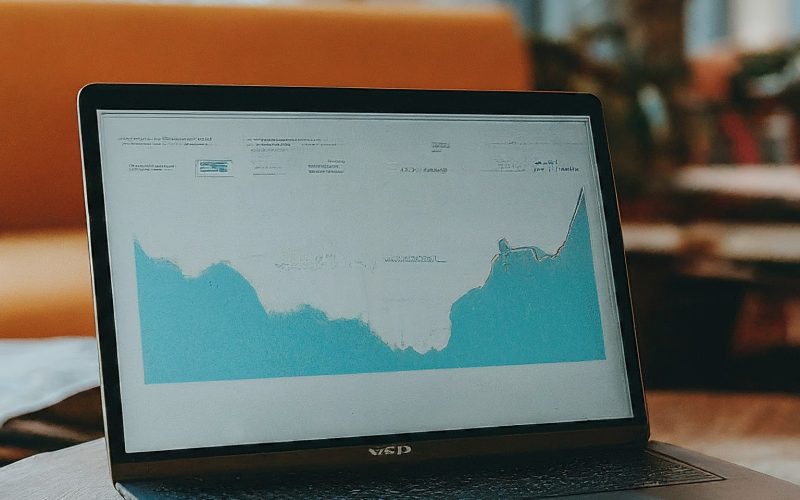

Investment Considerations for a Post-Bankruptcy WeWork

Investors will be cautiously optimistic about WeWork’s future. The company’s ability to deliver on its profitability goals and navigate an increasingly competitive co-working market will be crucial factors to consider.

Real Estate Implications of WeWork’s Restructuring

The future of WeWork is intertwined with the broader commercial real estate market. Landlords may view WeWork as a reliable tenant for underutilized spaces, but competition for prime locations is likely to remain fierce.

Emerging Trends in the Co-Working Industry

The co-working industry is constantly evolving. WeWork will need to adapt to stay relevant. Here are some key trends to watch:

- Increased focus on enterprise clients: Large companies are increasingly seeking flexible workspace solutions.

- Hybrid work model integration: Co-working spaces will need to cater to the growing hybrid work model.

- Emphasis on amenities and technology: Offering top-notch amenities and integrated technology will be essential to attract tenants.

Conclusion: WeWork’s Path Forward

WeWork’s journey out of bankruptcy marks a new chapter for the company. The road ahead is paved with both challenges and opportunities. By focusing on profitability, building trust, and adapting to evolving market trends, WeWork can carve out a sustainable future in the co-working landscape. However, business people, investors, and real estate professionals should carefully consider the company’s progress and the broader industry dynamics before making any strategic decisions.