Introduction: ChatGPT and Bard

Artificial Intelligence (AI) has taken the financial world by storm, promising data-driven insights and unbiased decision-making. Many investors now turn to AI models like ChatGPT and Bard to navigate the complex terrain of financial advice. But is it wise to trust these digital advisors with your hard-earned money? In this article, we delve into the intricacies of AI in the finance sector, weighing the pros and cons to help you make an informed decision.

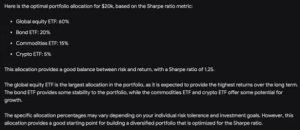

Google Bard’s Response:

Google’s AI model focuses on the importance of investing for the long term, rebalancing the portfolio, and diversifying it. Moving on, let’s see the results on ChatGPT models—GPT-3.5 (free version) and GPT-4 (paid subscription).

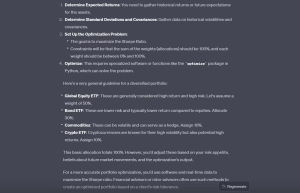

ChatGPT-3.5 Response:

ChatGPT-4 Response:

Even using the ChatGPT models, the focus is on the long-term aspect. In all cases, the portfolio allocation is designed to maximize the Sharpe ratio while still maintaining a diversified portfolio.

The global equity ETF provides exposure to the global stock market, which has historically offered the highest returns over the long term. The bond ETF provides exposure to fixed-income assets, offering lower returns and volatility. The commodities ETF provides exposure to commodities, which can offer inflation protection. The crypto ETF provides exposure to the cryptocurrency market, which is a new and volatile asset class.

But the situation can change. That is, traditional or even emerging asset classes can emerge victorious and offer higher returns depending on the market conditions. On the contrary, a potential financial market collapse can potentially wipe out your profits.

Understanding the Rise of AI in Finance

Artificial intelligence has revolutionized the financial industry in recent years. AI’s ability to analyze vast amounts of data, recognize patterns, and predict market trends has made it an attractive tool for personal finance. Before we delve into whether you should trust AI for financial advice, let’s explore the benefits and potential pitfalls.

Pros of Trusting AI for Financial Advice

AI systems bring a host of advantages to financial decision-making. Their data-driven analysis allows them to process vast financial data, scrutinize market trends, and dissect economic indicators, providing insights that might elude human advisors. Moreover, AI offers round-the-clock availability, eliminating the need for scheduling appointments. It also excels at removing emotional bias, enhancing the quality of advice. Lastly, AI-driven financial advisory services are often cost-effective, making high-quality guidance accessible to a broader audience.

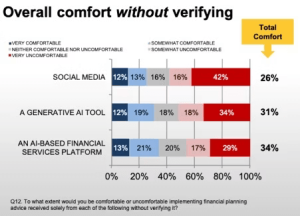

According to the Certified Financial Planner Board, 31 percent of US-based investors would consider following AI-generated financial advice without verifying it with another source, highlighting the growing trust in AI’s capabilities.

Cons of Trusting AI Models for Financial Advice

However, relying solely on AI for financial advice has significant drawbacks. AI models lack the ability to understand your unique financial situation and goals, leading to potentially misaligned recommendations. They are not immune to errors, and a single glitch or oversight can result in substantial losses. Moreover, AI lacks emotional support, which is crucial during turbulent market times. It also fails to consider broader life events that can impact your financial decisions.

Factors to Consider Before Using AI for Financial Advice

The decision to trust AI for financial advice should depend on your individual circumstances. Here are some factors to consider:

- Complexity of Your Financial Situation: If your finances are straightforward, AI may suffice. For more intricate situations, a human advisor’s nuanced insights could be beneficial.

- Risk Tolerance: AI may not fully understand your risk appetite, so consult a human expert if risk is a critical factor.

- Emotional Needs: If you require emotional support, a human advisor can offer empathy and reassurance.

- Cost Considerations: AI-driven advice is often cost-effective, making it suitable for tighter budgets.

- Hybrid Approach: Combining AI advice with human consultations provides the best of both worlds—data-driven analysis and personalized insights.

In conclusion, while AI has its merits, trusting it blindly for financial advice carries risks. Approach AI recommendations cautiously, consider its limitations, and ideally complement it with human expertise that can provide personalized, emotionally supportive, and context-aware guidance tailored to your unique financial journey. In the end, a hybrid approach may be the key to making the most of AI’s capabilities while safeguarding your financial well-being.

Audience: Problem Solver

Table: Pros and Cons of Trusting AI for Financial Advice

| Pros | Cons |

|---|---|

| Data-driven analysis | Inability to understand unique financial situations |

| Round-the-clock availability | Potential for errors |

| Removal of emotional bias | Lack of emotional support |

| Cost-effective financial guidance | Limited consideration of life events |

| Increasing trust among investors |